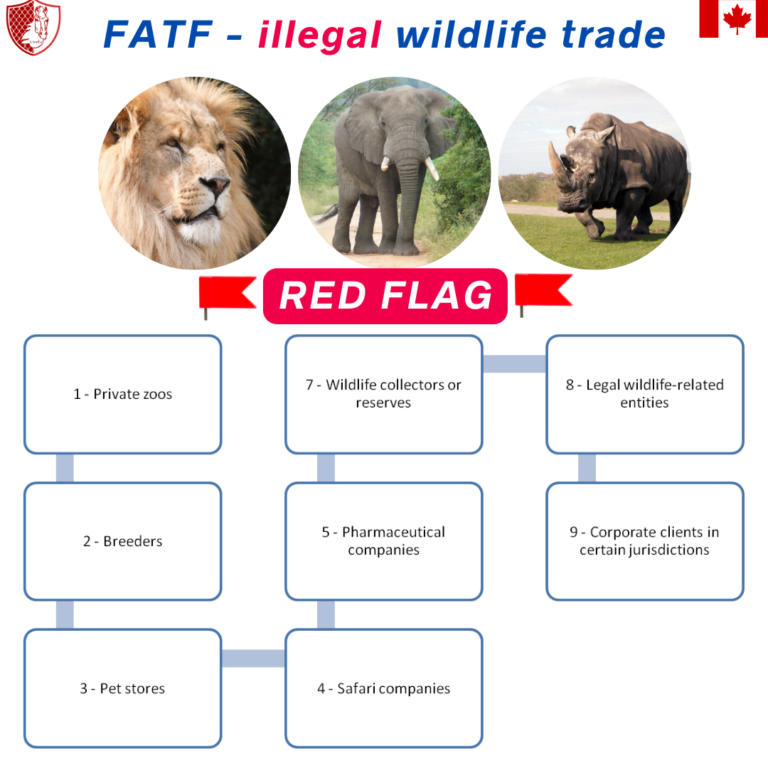

These are zoos that are privately owned and not open to the public.

Individuals or organizations that breed animals, often for sale or trade.

Retail establishments that sell pets, including exotic animals.

Companies that organize and conduct wildlife safaris or tours.

These are companies that manufacture medicines and may use wildlife-derived ingredients in their products.

People or organizations that collect or keep wildlife, sometimes in designated reserves.

Entities that are involved in legal activities related to wildlife, such as research, conservation, or education.

Companies located in areas where wildlife trafficking is prevalent or where illegal wildlife is often transited or sold.

LiveEx-Shield Case Manager is a groundbreaking solution that revolutionizes Anti-Money Laundering (AML) investigations by harnessing the power of ChatGPT. This cutting-edge technology empowers compliance officers by providing them with seamless access to critical resources such as Adverse Media and Virtual Assets, along with relevant details, thereby greatly enhancing their decision-making capabilities. With the integration of ChatGPT, LiveEx-Shield Case Manager uncovers hidden risks, significantly improves accuracy, and streamlines the entire investigation process. By automating time-consuming tasks, it reduces the reliance on manual efforts and significantly enhances operational efficiency. As the AML landscape evolves rapidly, it is crucial to stay updated with the latest trends and best practices. ChatGPT’s continuous learning feature ensures that LiveEx-Shield Case Manager remains up-to-date, offering real-time guidance during investigations. Compliance officers can rely on the system to navigate through the complex regulatory environment and make informed decisions. Transform your AML investigations with LiveEx-Shield Case Manager and actively contribute to building a safer financial landscape. Experience the power of this advanced solution today and gain a competitive edge in combating financial crimes. [Call-to-action]: Learn more about LiveEx-Shield Case Manager and how it can revolutionize your compliance efforts. Contact us now to schedule a demo or request further information.

Markets in Crypto-Assets Regulation (MiCA): A Cross-Jurisdictional Regulatory Framework for Crypto-Assets. The Markets in Crypto-Assets Regulation (MiCA) is a pioneering regulatory and supervisory framework designed specifically for crypto-assets. This groundbreaking initiative aims to establish the first-ever cross-jurisdictional regulatory approach in this domain. First introduced in 2020 as a response to the emergence of global stablecoins, MiCA is anticipated to take effect in 2024, pending ratification by the European Parliament, which is expected to occur in early 2023. MiCA plays a pivotal role in the broader objectives of the European Commission to create a robust regulatory framework that supports the adoption and integration of distributed ledger technology (DLT) and crypto-assets within the financial services sector.

To achieve this objective, MiCA has laid out several key goals. These include providing legal clarity and certainty for market participants, safeguarding the interests of consumers and investors, preserving market integrity and financial stability, fostering innovation, and addressing the complexities arising from the existence of fragmented national regulatory frameworks. The implementation of MiCA is poised to bring about significant advancements in the regulation and supervision of crypto-assets, instilling greater confidence and trust in the market. By establishing clear rules and guidelines, MiCA aims to enhance investor protection, mitigate risks, and promote a level playing field for market participants. Furthermore, this framework strives to encourage innovation in the sector while ensuring compliance with relevant anti-money laundering and counter-terrorism financing measures. LiveEx-Shield TMS, a customizable and adaptable solution, is fully prepared to adopt the requirements outlined by MiCA. With its flexible architecture, LiveEx-Shield TMS can seamlessly align with the evolving regulatory landscape. Compliance officers can rely on LiveEx-Shield TMS to effortlessly incorporate the necessary measures and safeguards mandated by MiCA. The platform empowers organizations to tailor their compliance processes and controls according to the specific provisions of MiCA, ensuring compliance while optimizing operational efficiency. As the first cross-jurisdictional initiative of its kind, MiCA sets a precedent for international collaboration in regulating crypto-assets. Its comprehensive approach seeks to harmonize regulatory standards across European Union member states, fostering a conducive environment for the growth and development of crypto-assets and their underlying technology

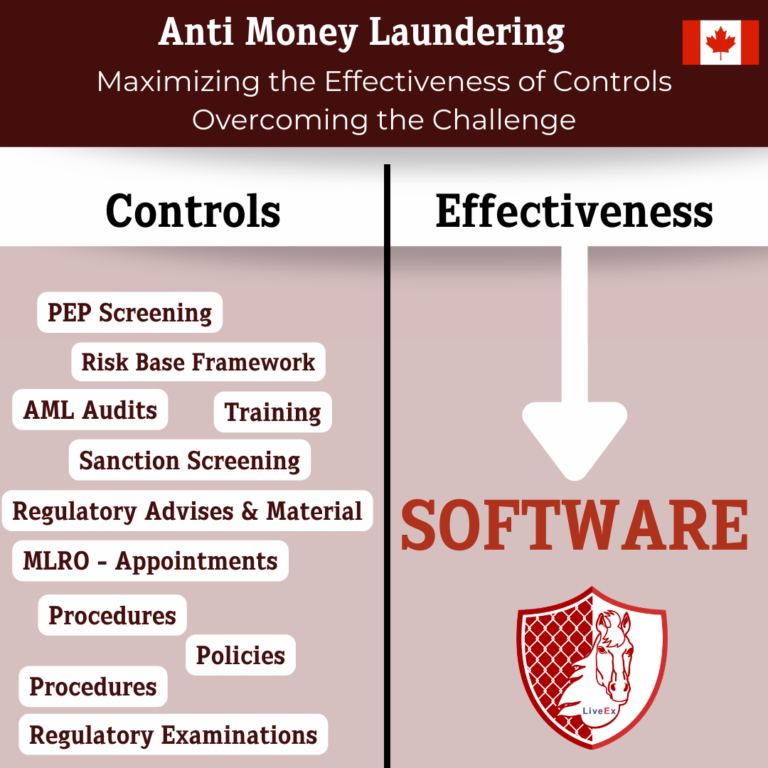

Transaction monitoring software (TMS) plays a crucial role in combating money laundering and ensuring compliance with anti-money laundering (AML) regulations. With its automated capabilities, TMS is designed to efficiently identify and analyze financial transactions, thereby detecting potentially suspicious activities. These activities may include transactions involving large sums of money, frequent transactions, or those associated with high-risk individuals or jurisdictions. By leveraging TMS, financial institutions can effectively comply with regulations, minimize the risk of financial crimes, and safeguard themselves against legal and reputational risks. The software generates alerts whenever suspicious activities are identified, enabling institutions to promptly report such activities to the relevant authorities.

In addition to its role in regulatory compliance, TMS facilitates the implementation of risk-based analysis procedures. It empowers institutions to identify and analyze risks associated with specific transactions and customers, which is essential for effective risk assessment.

Transaction monitoring software (TMS) plays a crucial role in combating money laundering and ensuring compliance with anti-money laundering (AML) regulations. With its automated capabilities, TMS is designed to efficiently identify and analyze financial transactions, thereby detecting potentially suspicious activities. These activities may include transactions involving large sums of money, frequent transactions, or those associated with high-risk individuals or jurisdictions. By leveraging TMS, financial institutions can effectively comply with regulations, minimize the risk of financial crimes, and safeguard themselves against legal and reputational risks. The software generates alerts whenever suspicious activities are identified, enabling institutions to promptly report such activities to the relevant authorities.

In addition to its role in regulatory compliance, TMS facilitates the implementation of risk-based analysis procedures. It empowers institutions to identify and analyze risks associated with specific transactions and customers, which is essential for effective risk assessment.

150 Consumers Road, Suite 301, North York ,ON, Canada M2J 1P9