Our Products

- Home

- Our Products

Anti-Money Laundering Screening

AML Name Screening is one of the risk assessment methods for existing or potential customers of an organization subject to AML obligations. Businesses should use AML screening software to scan their current and potential customers for sanctions, PEP, blacklists/wanted lists, and unwanted media data. Businesses should use AML screening software to scan their current and potential customers for sanctions, PEP, blacklists/wanted lists, and unwanted media data.

Anti-money laundering screening is a key component of anti-money laundering compliance

Screening Required

- a) Businesses are required to perform name screen when on boarding customer to comply with anti-money laundering regulations.

- b) Risk levels for existing customers may change over time. Therefore, companies should regularly check them through name screening.

- c) Businesses should use The Ultimate Beneficial Owner to scan the organizations/individuals they wish to do business with. (d) While making transactions- Allows screening transaction data against sanction list databases and detecting risk throughout beneficiaries, senders, and other data elements

Name Screening

Name screening systems contain two purposes. The first purpose is to create a risk assessment.

Risk assessment is critical as it helps entities identify high-risk customers and take necessary measures to monitor their financial activities.

Know Your Customer (KYC), Customer Due Diligence (CDD), and Enhance Due Diligence (EDD) are other compliance programs that help companies create risk assessments. The second purpose of name-checking is to help entities to identify and report suspicious activity.

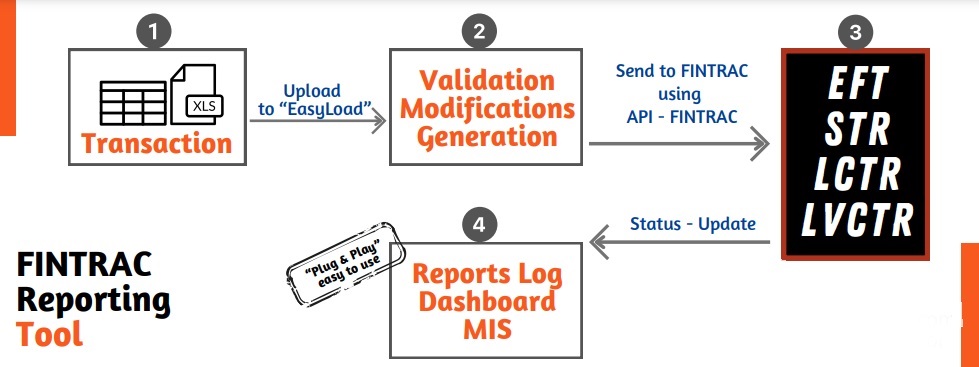

A Comprehensive Fintrac Reporting Solution

EasyLoad is an advanced software solution tailored to meet the stringent reporting requirements of Fintrac. Designed with efficiency and ease of use in mind, EasyLoad streamlines the entire process of preparing, validating, and submitting various regulatory reports. This comprehensive tool enables organizations to comply with anti-money laundering (AML) and counter-terrorist financing (CTF) regulations, ensuring that all reportable transactions are managed with accuracy and security.

DNFBPs

One of the risk assessment techniques for current or potential clients of an entity subject to AML responsibilities is AML Name Screening. Using AML screening software will allow businesses to check their present and prospective clients for sanctions, PEP, blacklists/wanted lists, and undesirable media material. Using AML screening software will allow businesses to check their present and prospective clients for sanctions, PEP, blacklists/wanted lists, and undesirable media material.

Real Time Business Solution

Real-time business solutions from Circuit Computer could aid in streamlining the DNFBP’s operational procedures. Circuit Computer built the LiveEx DNFBPs solutions with the needs of the customer in mind and in accordance with the FATF recommendations.

After a successful login, the LiveEx-Shield system offers a thorough dashboard for instant examination. Live EX offers real-time business solutions that could aid in streamlining the DNFBP’s operational procedures. Circuit Computer prioritises customer needs and developed the LiveEx DNFBPs solutions in accordance with the FATF recommendations, the Central Bank of the UAE, the Ministry of Economy, the FIU, and other international regulations.

Fintechs

The best option for fintech companies that must monitor their transactions for compliance with anti-money laundering laws is our AML Transaction Monitor System, LiveEx-Shield. The programme can manage high-volume transactions for both inbound and outbound activity, payment channels, and cross-border remittances. Digital KYC solutions are offered by the LiveEx-Shield software to confirm consumers’ identities and guarantee that transactions are lawful. This is a crucial part of AML compliance because it aids fintech companies in preventing fraud and safeguarding their brand.

Crypto Platforms

For cryptocurrency exchanges wishing to stay on top of their regulatory compliance activities, LiveEx-Shield is the ideal answer. With a focus on digital KYC, payment channels, and large volume transactions for both incoming and outbound transactions, our AML Transaction Monitor System is especially created to meet the specific needs of cryptocurrency exchanges. We are able to offer our clients a seamless and effective experience while also ensuring that they continue to adhere to local and international regulatory requirements thanks to our cutting-edge technology. Our programme is made to identify and stop money laundering, financing of terrorism, and other fraudulent acts that might be connected to the exchange of digital assets.

Jewelers , RealEstat and Accountants

Businesses in the jewellery, real estate, and accounting industries face unique challenges when it comes to complying with anti-money laundering (AML) regulations. These industries are highly vulnerable to money laundering and terrorist financing activities, and as such, must comply with stringent reporting requirements to the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC).

Goaml

Introduction of goAML platform has been viewed as one of the fundamental regulatory requirement in the battle in against to money laundering and terrorist funding. Based on the country wide risk evaluation performed in UAE and the enforcement of AML (Anti-Money Laundering) /CFT (Countering Financing of Terrorism) law which grew to be high-quality in year 2018 in the country, the regulatory authorities in the area have been emphasizing the significance of goAML platform and its utilization by means of the business entities

TMS

A comprehensive tool to monitor all transactions, ensuring risk-based business segments and thresholds are in place based on regulatory typology assessments. A well-defined Transaction Monitoring Program is an important component of an effective AML & CTF program. Monitoring refers to the monitoring of customer transactions, including assessing historical / current customer information and interactions to provide a complete picture of customer activity.

FATF Standards

As per the FATF, AML and CTF procedures and acknowledges the subsequent factors as determinants of the correct extent of AML/CTF controls:

- 1: The volume and size of transactions

- 2: The distribution channels that are used

- 3: The degrees of risk that are associated with each area of the financial institution’s operation

- 4: The extent to that the financial organization is dealing through intermediaries, third parties or non-face-to-face access (if applicable)

- 5: The customer, product, and activity profiles of the financial institution

- 6: The nature, scale, and complexity of the business

- 7: The diversity of a financial institution’s operations, including where they operate geographically

Risk-Based Approach

The British regulator is the first proposing Risk-Based Approach, the Financial Conduct Authority (FCA), in 2000. With this recommendation The Financial Action Task Force (FATF) first utilized the risk-based approach in 2007, with FATF, global organizations such as FATF member countries, Wolfsburg Group, and International Organization of Securities Commissions adopted the risk-based approach principle. Since then, the “risk-based approach” has definitely turned out to be one of the most broadly used expressions in the subject of anti-money laundering (AML).

Risk Mitigation

A comprehensive tool to monitor all transactions, ensuring risk-based business segments and thresholds are in place based on regulatory typology assessments. A well-defined Transaction Monitoring Program is an important component of an effective AML & CTF program. Monitoring refers to the monitoring of customer transactions, including assessing historical / current customer information and interactions to provide a complete picture of customer activity.

Assessing of Residual Risk

The LiveEx system is provides four categories in the RBA Framework such as Low, Medium, Medium High and High. In determining these ratings, the LiveEx system considers the categories in both inherent and residual risks. The residual risk rating can be customized according the nature, size and complexity of the business by the organization MLRO or Reporting Officer. Based on the inherent risk and mitigation control the LiveEx system will

DE - RISK

- • Identify inherent risks

- • Develop risk mitigation measures

- • Evaluate effectiveness of measures

- • Calculate residual risk level

- • Evaluate against risk appetite

- • Implement additional measures if needed

- • Periodically review and adjust measures

- • Monitor and report residual risk levels

- • Continuously assess and manage risks.

AML/CFT Behavior

The increasing number of AML/CFT cases and scenarios indicates traditional compliance approach is not enough to mitigate the financial institutions business risks. The wrong doings encourages consultants to invest in Monitoring-Solutions to help Banks, Finance companies, and Regulated business firms.

The Data scientists have assumed their essential job as an impetus in the business-compliance process. TargetTMS is the best-fist transaction monitoring solution that gives practical and most dependable answers for AML/CFT problems.

KYC-CDD-ECDD

- • Identity verification , Face detection, Face alignment,Liveness detection

- • Anti-spoofing measures

- • Multi-factor authentication

- • Client eKYC – Consent based input

- • Document authentication

- • Risk assessment

- • Watchlist screening

- • Enhanced due diligence (EDD)

- • Ongoing monitoring