AI-driven comprehensive AML tool. Configurable tool to translate company AML policy into implementation

1,700 global sanctions lists, PEP, Adverse Media, Real-time API, reduced false positives

A comprehensive risk assessment framework, highly configurable, along a factor-based approach

AML compliance-driven system for money service (MSB) FX exchange: remittance, financial accounting

EFT, STR, LCTR, LVCTR – FINTRAC API and goAML reports are ready to publish. It’s a plug-and-play solution.

AI-driven case manager, alert manager, ID manager, profile management, investigations

We offer AML software solutions in Canada that are completely in sync with regulatory AML/AFT compliance guidelines. Experience the power of LiveEx-One, our cutting-edge Transaction Monitoring System (TMS) tool designed to elevate your regulatory compliance strategy. LiveEx-One is fully equipped to seamlessly integrate with regulatory reporting frameworks, ensuring a compliant and streamlined experience for our clients.

LiveEx-One is a comprehensive solution for onboarding, screening, risk assessment, rules, smart rules, KYC, risk mitigation, case management, investigations, non-face-to-face transactions, risk overrides, and regulatory reporting.

LiveEx-One features robust mechanisms for data validation, ensuring accuracy and integrity. Comprehensive checks confirm data authenticity, while thorough risk assessments meet rigorous compliance standards. Continuous monitoring maintains regulatory adherence throughout your operations.

Our journey has been bolstered by the unwavering support and transparent SDK documentation from FINTRAC. We extend our heartfelt gratitude to the dedicated team at FINTRAC for their exceptional assistance!

Empower your business with LiveEx-One and join us in navigating regulatory landscapes with confidence. Let’s connect, comply, and conquer together!

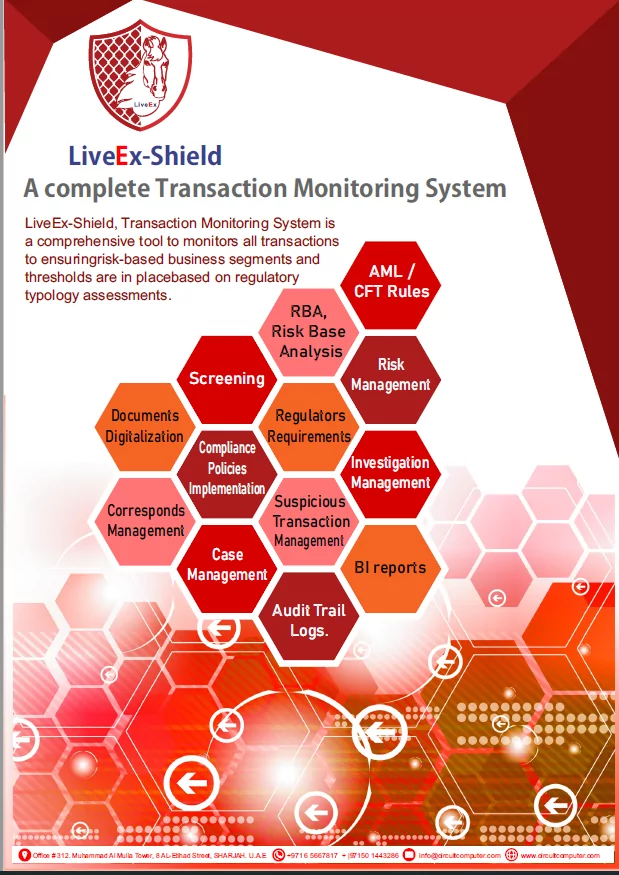

LiveEx-Shield’s TMS is designed to help organizations comply with the regulatory requirements

related to anti-money laundering and counter-terrorist financing by helping them comply with the regulatory requirements relating to these areas. By automating many of the compliance processes and enabling extensive reporting capabilities, it is believed that the LiveEx-Shield TMS can assist organizations in demonstrating to regulators that they are taking their compliance obligations seriously by helping them.

LiveEx-Shield TMS analyzes transactions in real-time in order to quickly identify potentially

suspicious transactions using a combination of algorithms . This can include odd patterns of transactions, transactions that exceed certain thresholds, or transactions involving high-risk customers that have unusual transaction patterns. In the process of detecting suspicious activities, the LiveEx-Shield TMS is able to prevent money laundering and other financial crimes from occurring.

With LiveEx-Shield’s TMS, compliance processes can be streamlined and the amount of time

spent on manual entry can be reduced, which in turn leads to a reduction in operational costs. A compliance team that is able to focus on high value-added activities such as investigations as well as reduce costs and improve operational efficiency as a result of this can help to reduce costs and improve operational efficiency.

Many of the compliance processes required by regulators can be automated using LiveEx-Shield TMS,

including identifying and verifying customer identities, screening customers against sanction lists, monitoring transactions, and producing reports. The automation of compliance processes reduces the risk of human error and ensures a consistent and efficient performance of the compliance processes.

At CircuitComputer International, we are uniquely positioned to offer high quality services at competitive prices. Circuit Computer Software is close to major financial institutions, ensuring smooth business flow, reducing risk, cost, and management activities. The company not only has the latest technology gadgets but also the most knowledgeable and experienced staff to provide customized solutions that are user friendly. With proven experience, Circuit Computer International can establish dedicated teams to offer a range of services. As a highly motivated team, we aim to provide our customers with an innovative solution that exceeds their expectations and simultaneously influences and raises the communities in which we operate.

Fraud prevention, KYC compliance, and identity and age verification are all offered by LivExShield.com.

Establish trust, verify customers, comply with KYC, fight crime, and work globally Besides preventing fraud.

LiveEx-Shield ensures KYC compliance and ensures age and identity verification, as well as increasing conversion rates.

Identify and stop fraudsters

With our extensive fraud prevention and anti-money laundering services, including network analysis, automated ID review, and biometric extraction, you can welcome more honest customers and lock out fraudsters.

User-friendly interface

It shouldn’t be a barrier for sign-ups to require document verification. You can identify your customer . using a selfie and an ID photo They can take flawless shots every time since they have Assisted Image Capture as their personal automated photography coach.

Verification that is extremely accurate

By combining machine learning and artificial intelligence, we are able to perform document authentication and electronic age verification consistently well.

Financial establishments likewise have some regulations to combat Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) and these businesses must adhere to the regulations. The avoidance of money laundering activities not only applies to financial organizations functioning as banks but still issued some guidance on FATF Designated Non-Financial Businesses and Professions (DNFBP).

Financial establishments likewise have some regulations to combat Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) and these businesses must adhere to the regulations. The avoidance of money laundering activities not only applies to financial organizations functioning as banks but still issued some guidance on FATF Designated Non-Financial Businesses and Professions (DNFBP).

Circuit Computer provide real time business solutions which may help to streamline the DNFBPs business processes. Circuit Computer focus on the needs of customers and designed the LiveEx DNFBPs solutions as per the FATF recommendations.

The LiveEx-Shield system provides comprehensive dashboard after the successful login for quick analysis. Live EX provides real time business solutions which may help to streamline the DNFBPs business processes. Circuit Computer focuses on the needs of customers and designed the LiveEx DNFBPs solutions as per the FATF recommendations, Central bank, Ministry of Economy, FIU and other international standards.

Compliance program requirements issued guideance came into effective on June 1, 2021. The compliance program requirements under the Proceeds of Crime (Money and Terrorist Financing Act (PCMLTFA) and associated Regulations apply to all reporting entities (REs)

16.14.2

Where a customer is determined to be a DNFBP, the Licensed Person must carry out the following required steps, in addition to the CDD and EDD required by Paragraph 16.11 of these Standards and any other EDD appropriate to manage the risk of the customer

Tipping-off and confidentiality Financial institutions, their directors, officers and employees should be:

a) Lawyers, notaries, other independent legal professionals and accountants should be required to report suspicious transactions when, on behalf of or for a client, they engage in a financial transaction in relation to the activities described in paragraph (d) of Recommendation 22. Countries are strongly encouraged to extend the reporting requirement to the rest of the professional activities of accountants, including auditing.

b) Dealers in precious metals and dealers in precious stones should be required to report suspicious transactions when they engage in any cash transaction with a customer equal to or above the applicable designated threshold.

c) Trust and company service providers should be required to report suspicious transactions for a client when, on behalf of or for a client, they engage in a transaction in relation to the activities referred to in paragraph (e) of Recommendation 22.

150 Consumers Road, Suite 502, North York ,ON, Canada M2J 1P9